It’s graduation season! Across the country, college students are donning their caps and gowns, marching to “Pomp and Circumstance,” and taking the next big step in their adult lives: Finding their first post-grad job.

One thing that has defined millennials has been their financial woes: Graduating into the Great Recession of 2008, carrying crippling student loan debt, and struggling to build wealth during periods of high inflation and rising cost of living. Now that Gen Z is graduating and joining the workforce, will this generation face the same challenges?

We surveyed 1,000 college students and recent graduates (most of them members of Gen Z) to learn more about the job landscape they face and their saving and spending behaviors. What we found is that many of them are hopeful about their job prospects and trying to save and invest where they can — but most are still having a hard time finding good jobs with salaries high enough to cover all their bills.

Key takeaways:

- 34% of college students and recent graduates do gig work to make extra cash.

- 69% of recent graduates do gig work, with 31% reporting that as their main source of income.

- 21% of college students have less than $100 in the bank, while 61% have less than $1,000 saved.

- Nearly half of college students either don’t have a savings account, or have one but haven’t put any money in it.

- 30% of college students use an app to help manage their monthly budgets.

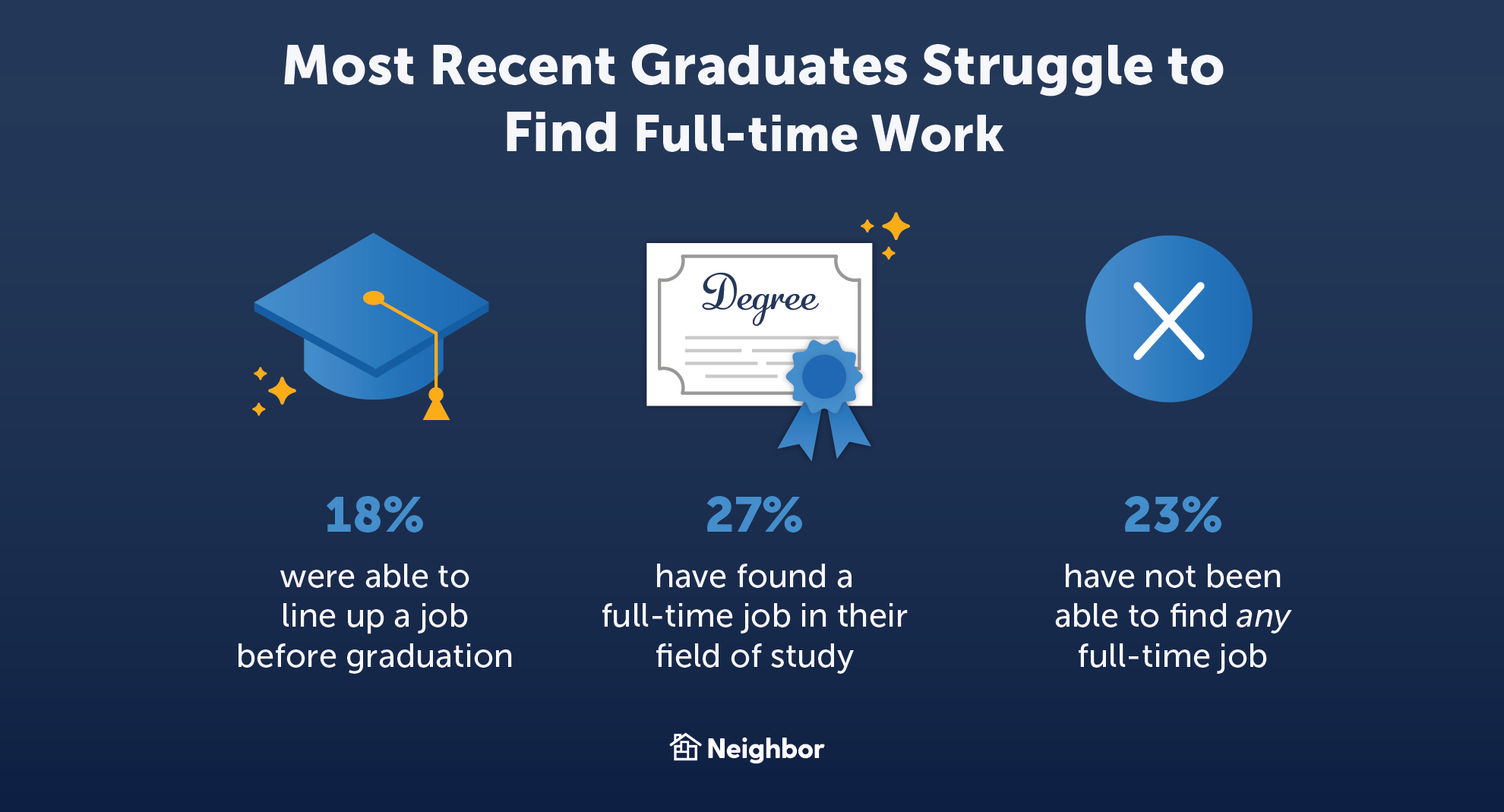

- Only 27% of recent college graduates say they have a full-time job in their field of study. 23% say they still haven’t found any job at all.

- 64% of recent graduates say they don’t earn “enough” to cover their bills and discretionary spending.

Gig Work is the Most Common Way for Young People to Make Extra Money

While many college students and recent graduates work part-time to help cover their bills, we found that gig work is the most common way for young people to earn extra money.

1 in 3 Recent Grads Would Invest Extra Money (If They Had It)

College students and recent graduates seem to have some financial awareness — many shared that they would use extra income (if they had it) to invest or pay off debt.

As for extra income after graduating? The top three things recent grads report spending their discretionary income on are clothes and accessories, hobbies, and weekend entertainment.

21% of College Students Have Less Than $100 in the Bank

61% of college students have less than $1,000 in the bank, and about 1 in 5 reports having less than $100. What’s surprising, though, is that younger college students are more likely to have more money saved — the majority of those with less than $100 in the bank are over 25.

Perhaps unsurprisingly considering the above numbers, nearly half (47%) of college students either don’t have a savings account, or have one but have no money in it.

Meanwhile, 59% of college students either don’t have a credit card at all, or have one that they use only for emergencies.

Another sign that college students are financially responsible, even though most of them have little money to spend? The majority of them budget their finances. While some use journals or spreadsheets or simply keep mental track of their spending, the largest share of college students use a budgeting app to manage their finances.

To help them with their living expenses, almost 3 in 4 college students say they’ve received help from their parents.

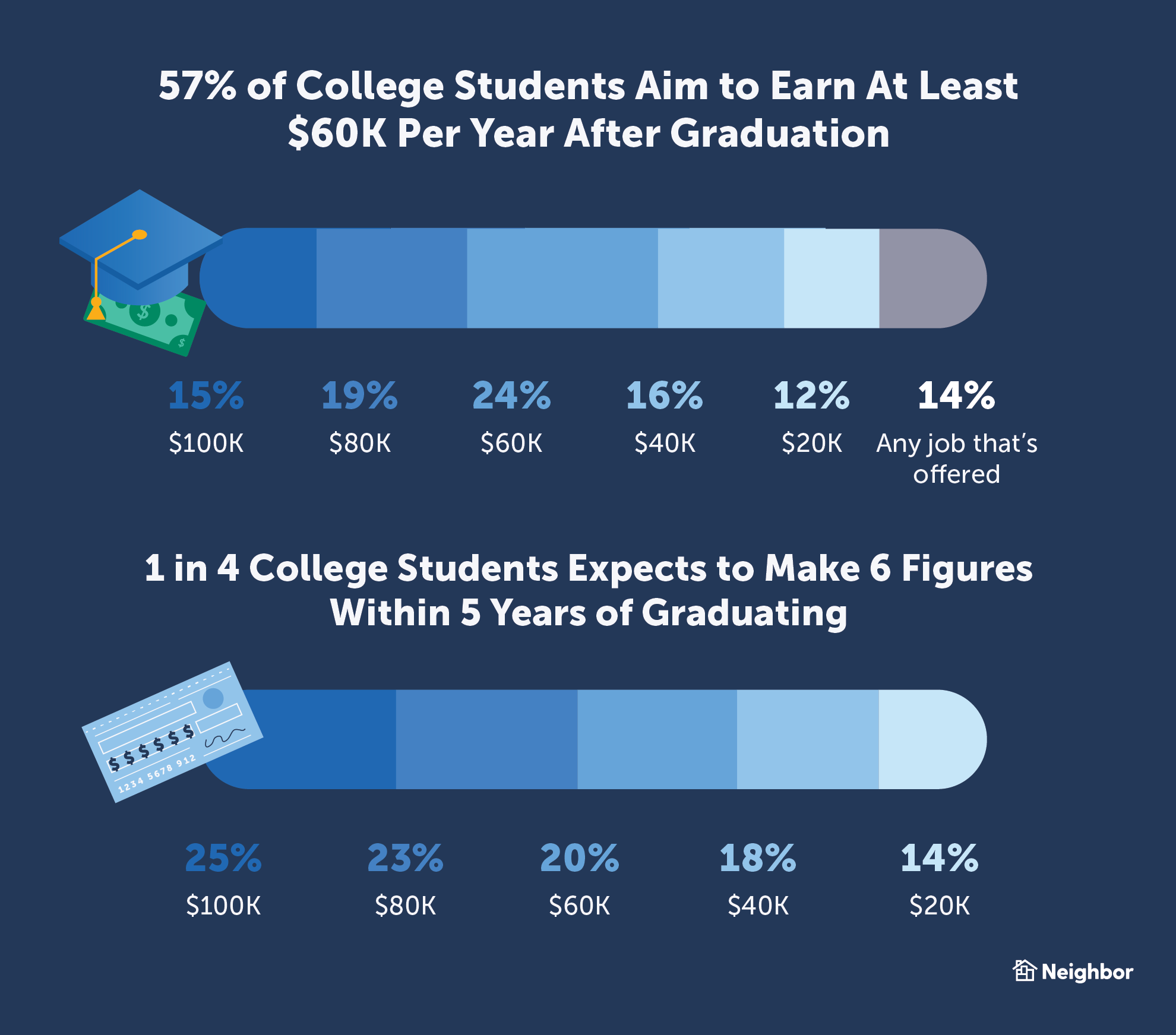

1 in 4 College Students Expects to Make 6 Figures Within 5 Years of Graduating

Our survey also revealed that today’s college students have an optimistic view of their future earning potential. When asked about their post-grad salary goals, more than half said they were aiming to earn at least $60,000 per year in their first job after college.

College students have even loftier goals for a few years after graduating, with 1 in 4 expecting to earn six figures within 5 years of starting their career.

Despite students’ hopeful outlooks about their future salaries, the unfortunate reality is that many new grads are struggling to find full-time, well-paying jobs — in their chosen career fields or otherwise. In fact, only 18% said they were able to line up a job before graduation, and only 27% of respondents who graduated in the last five years said they’ve been able to find a full-time job in their field of study. 23% of respondents who graduated in the last five years said they haven’t been able to find any full-time job yet.

The struggles new graduates are having with their job hunts seem to also affect their paychecks. 64% of recent graduates said they don’t earn enough to cover their bills and discretionary spending. That’s despite the fact that 46% of recent grads don’t pay for their housing, either because they live with their parents, or because someone else pays their rent or mortgage.

69% of Recent Grads do Gig Work

This next finding is unsurprising, considering how many recent grads are struggling to find work, as well as the meteoric rise of gig work platforms in recent years: More than two-thirds of recent college graduates are doing gig work, either as a main source of income or to help make ends meet in addition to another job.

69% of survey respondents who graduated within the last five years said they do gig work in some capacity. 31% said gig work is their main source of income.

That means that most of the recent grads need a side hustle to help supplement their entry-level salary. That may be helping them put more money away, which is unsurprising, considering 46% of recent grads said they spend 75% or more of their money on bills.

The largest share of recent grads say they’re only able to save about 10% of their income, with only 35% saving the recommended minimum of 30% of your annual salary.

Doing gig work might also be helping recent graduates repay their student loans faster. Nearly 40% said it would take them at least 5 years to pay back their loans.

Survey Methodology

Using Pollfish.com, we surveyed 1,000 college students and recent graduates on April 4, 2022. Respondents had to answer that they were currently in college or had graduated within the last five years to qualify to continue with the survey.

Survey respondents were all based in the U.S.

Respondents were 53% male and 47% female, and were mostly young people going to college at a traditional age (56% of respondents were under 35). Their ages were:

- 16-17: 0.5% of respondents

- 18-24: 25% of respondents

- 25-34: 30.4% of respondents

- 35-44: 24.1% of respondents

- 45-54: 10.4% of respondents

- Over 54: 9.6% of respondents