Are you taking advantage of all property management revenue streams available to you?

It’s easy to fall into a groove in terms of your process and focus on one aspect of revenue generation.

For example, maybe you’ve been looking forward to that rent increase you’ll be able to initiate soon. Before you know it, you’re absorbed in your day-to-day activities, growth stagnates, and new revenue streams are an afterthought.

There are opportunities to increase your property revenue right under your nose, whether you’re a property manager or rental investor (or both). Unfortunately, these new income streams may have faded into your peripheral vision.

That’s why, in this guide, we’ll talk about how to increase revenue streams on your properties and some unique revenue generation opportunities you may not have thought of yet.

17 Ways to Increase Your Property Management Revenue Streams

Here are seventeen ways to increase the revenue of your rental properties:

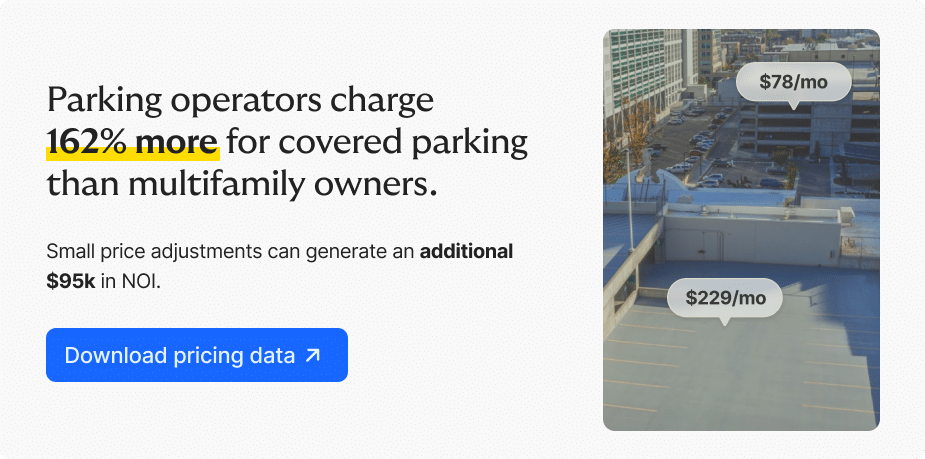

1. Offer VIP Parking

Charging for parking is a pretty standard practice. However, you can take this a step further and consider offering “VIP” parking spaces.

Reserve a small set of parking spaces in the closest and most convenient locations to the property and rent them out for a small additional fee.

How much you charge will depend on your market, but you can easily tack on an extra $20-50 to tenants’ monthly rent.

2. Offer On-Site Storage

If there’s one thing residents are universally missing, it’s storage.

We inevitably build up “stuff” over the years. Even still, we’re hesitant about letting things go.

Storage is easily one of the most reliable streams of revenue, as you can charge monthly based on the size of the space. Turn vacant apartments or unused office space into rentable storage space.

Read this article for more information on how to open up ancillary revenue streams.

3. Charge for Valet Trash

A relatively new but incredibly popular amenity is valet trash.

How it works: The resident pays anywhere from $20-40 per month for the management team to pick up their trash and deposit it at the weekly trash pick up.

This helps property management teams control overages and mitigate mess in the central trash bins. Plus, it’s also a great way to introduce a new monthly revenue stream tenants are happy to pay for.

4. Rent Vacant Parking Spaces to Non-Residents

More apartment complexes than ever are renting their vacant parking spaces to non-residents during periods of high vacancies/low occupancy.

In most cases, multifamily parking spaces will look and function like any traditional parking space. They’ll resemble one another in terms of their amenities, location desirability, and overall space availability. Because of these similarities, multifamily parking spaces can easily satisfy the needs of vehicle owners who would otherwise rent traditional commercial parking spaces.

Extending parking to non-residents yields several benefits, including:

- It helps property owners bridge revenue gaps during extended lease-up periods

- It generates free leads. When parkers are on-site, they may express interest in a property tour.

- It serves as a consistent revenue stream that’s [mostly] immune to the forces of fluctuating vacancy rates.

The best part is that, to a parker, a multifamily parking lot may be a more attractive option than a standard commercial parking garage. What residents (prospective and existing) will see as luxuries, non-residents will see as an affordable alternative, especially when resident parking rates are ~30% cheaper than the parking rates of neighboring commercial parking garages.

5. Offer Furniture Rentals

Furniture rental is another nice feature that tenants will actually pay for, particularly in higher-priced markets.

The ability to pay a little extra per month to rent a full set of new furniture means you don’t have to slug your own stuff into your new home (or buy brand-new furniture). That’s a big upsell.

6. Charge Application Fees

This is a simple and popular strategy, but it’s still an opportunity many smaller property owners don’t seize.

Not every applicant works out, so it’s important to charge an application fee (typically around $30-75 upfront, but it can be more) to cover the time it takes you or your team to review the applicant.

This isn’t generally a great money maker, but it is useful for covering the management costs.

7. Redecorate

Redecoration is a property management company-specific revenue stream, but it’s a great one if you’re a PM looking for ways to increase revenue.

With redecoration, property management companies can charge the owner a fee of a few hundred dollars (which will either be charged at move-out or move-in). In return, the property will redecorate the unit and prepare it for the given tenant.

This typically involves tasks such as repainting, replacement of basic fixtures/applicances, and other normal wear-and-tear-related touch-ups.

8. Build a Business Center

Another great option is designating an office space where residents can retreat to a quiet space, connect to central Wi-fi, and even print, scan, and copy documents as needed.

You can charge for business center access as a one-time rental or a monthly fee, or you can simply charge for printing. The choice is up to you.

You can also include a rentable conference space as well, perfect for work-from-home residents who need a professional space on occasion.

9. Charge for Internet/Cable

Now, let’s talk a bit about bundling utilities and similar services. If you have a large number of units, you may be able to get bulk pricing for cable and/or internet.

You can then charge your residents a standard rate for those services and bring in a profit (or consider it an additional amenity and raise your rental rates accordingly).

10. Package Bulk Gas/Electricity

Like you would with internet and cable, you can consider offering utilities, namely gas/electric, as part of a monthly package.

For this to work, you’ll need to charge your residents a set rate. That means you’ll need to have a very good idea of your average cost per month on each utility you charge. This way, you can ensure you’re making a profit (and not eating the cost).

11. Offer On-Site Laundry Services

Laundry is a tried-and-true revenue stream for maximizing profits in large rental complexes, but one worth mentioning due to its consistency and how easy it is to set up.

Adoption is super high, and you can continue to profit years after you’ve paid off your laundry units.

Alternatively, you can go with a servicing company. That will cost you a percentage of your monthly laundry profits, but in exchange, the company services all your laundry units.

12. Charge for Pest Control

It’s relatively common to charge tenants directly for pest control, especially as it is the tenant’s duty to keep the unit clean (assuming you did your due diligence when cleaning and preparing the unit for move-in).

With that said, if you’re not doing it yet, charge tenants for pest control services. While this isn’t a consistent stream of revenue, it’s a great way to combat the regular cost of pest control.

13. Charge Unit Damage Fees

Similar to redecoration—but relevant to both property managers and owners—instating unit damage fees passes off the cost of post-lease fixes to the previous tenant, effectively increasing your revenue.

In most states, requiring the tenant to pay for damages that fall within the normal “wear-and-tear” spectrum is illegal.

However, beyond that, you’re typically allowed to charge tenants for damage done to the interior of the unit, so long as it is stipulated in your lease agreement beforehand.

These costs can go quite high depending on the work that needs to be done. So, while not a consistent revenue stream, this is another opportunity to protect your regular rental income without it costing you.

14. Charge for Filter Replacement

Replacing AC filters is a simple thing, but something that tenants often forget to do. Why not help?

By offering to order replacement filters for your tenants and charging them, you can get a discount from a local supplier while profiting from the difference.

This is a small– but great– option to add to your list of revenue streams that tenants will see as a useful service.

15. Enforce Pet Rent

Many properties don’t allow pets in light of the added maintenance (and post-move-out clean-up).

And while that’s a valid way to manage your properties, those that do permit pets often find that:

- Their occupancy rate is higher, and their tenants are more loyal

- Pet rent is a valuable revenue stream

Typically in the range of $50-100 per month, depending on the market, pet rent is arguably the best and most consistent additional revenue stream there is.

After all, pet owners love their pets and are happy to pay for a comfortable home for their furry family members.

Just remember to charge a pet deposit as well to cover any potential damages when the tenant moves out, so you’re not stuck with the added end-of-lease expense.

15. Offer Metered Water

Similar to what we spoke about earlier with regard to bulk electricity or metered gas, metered water offers a similar opportunity.

However, where this differs is in the fact that you have a few different options for generating extra revenue:

- Bulk flat rate: Same idea as bulk electricity: know your usage and charge a flat rate that covers your cost + profit.

- Individual metered billing: Tenants aren’t crazy about metered utility usage, but the basic idea here is to charge based on the meter + issue a service charge that allows for some profit.

16. Include Common Area Maintenance in Your Fees

A common area maintenance fee is charged to tenants for the upkeep of all common areas.

This is great because once the devices, furniture, and appliances in your common areas are fully paid off, your common space maintenance fee is almost pure profit (minus the cost of routine cleaning).

That being said, this is yet another fee you’ll need to sell your tenants. To convince that this common area is worth paying extra for, you’ll need to offer a number of attractive amenities to convince residents to pay (pools, hot tubs, ping pong tables, pool tables, barbeques, etc.)

17. Offer Unit Upgrades

Lastly, unit upgrades are an incredibly profitable stream of income that works particularly well in higher-end communities (whether you’re a property owner or a property management company).

The basic idea is this: you offer potential unit upgrades that residents can choose to pay for– such as upgraded kitchen appliances– then you collect a fee.

Once that tenant moves out, the unit retains those upgrades, so your fee was ultimately mostly profit (minus wear-and-tear).

Further reading:

Looking to learn more about maximizing the return on your rental property or property management business? Check out these posts from the Neighbor blog:

- Real Estate Investing 101: A Comprehensive Beginner’s Guide

- How to Build a Real Estate Empire

- How to Make Land Pay for Itself

Make the Most of Your Rental Portfolio

There are countless ways to generate additional revenue through your portfolio of rental properties. Which of those you decide to utilize is entirely up to you.

No matter which you implement, we hope this list has provided at least a few ideas you’ve never heard of or considered.

Now, how about a bonus tip?

Arguably the most versatile revenue stream of all and one that can help solve the issue of lost revenue due to vacant properties: renting out empty property for storage space.

With Neighbor’s peer-to-peer storage marketplace, you can promote your property to those looking for extra storage space quickly, easily, and safely.

The result? You generate additional revenue from your vacant units, unused properties, parking lots, you name it.

Properties and units that were once costing you, now instantly become a revenue-generating asset, allowing you to bridge the gap between onboarding new tenants, construction, or a sale that’s been dragging on (or fallen through).

Learn more about how to become a host with Neighbor here and start maximizing the return on your portfolio.