ROI (or “Return on Investment”) is a critical metric in multifamily real estate. Without knowing and understanding the ROI, it’s difficult to analyze multifamily investment opportunities or measure the performance over time.

While a simple formula, multifamily ROI can help investors determine profitability and compare one multifamily real estate investment to another. That way, they know which properties in their portfolio are high-performing.

Here is a step-by-step guide on calculating the ROI of a multifamily property and a few tips for increasing ROI over time.

ROI in Multifamily Real Estate

In multifamily investing, ROI can be expressed as annualized or cumulative. In either case, the basic formula all real estate investors should know for ROI is:

ROI = (Net Profit ÷ Initial Investment) × 100

Note that the net profit is the total earnings (or profit) generated after deductive expenses. The initial investment figure is an accumulation of renovation costs, closing costs, the initial purchase price, and any other upfront expenses.

For example, if you invest $1,000,000 in a multifamily property and generate $100,000 in net profit, the ROI is 10%.

ROI is an important metric in an investment portfolio, as it allows you to set benchmarks and expectations for the future. If a property in your portfolio isn’t meeting (or exceeding) the threshold for success you’ve set, you’ll need to explore creative strategies for boosting NOI and increasing rental property valuation.

ROI-Related Terminology and Variations in Calculation

If you are looking at the basic profitability and success of a real estate portfolio, the traditional ROI calculation should be enough. However, a few other variations to ROI calculation are worth understanding.

- Cash-on-Cash Return: Focuses on the actual cash invested versus the cash flow received. Most commonly used as a measurement for short-term profitability.

- Internal Rate of Return (IRR): Accounts for the time value of money. It’s a common metric used by larger investors and syndicators to evaluate projects and opportunities. IRR is used to assess long-term investment performance.

- Cap Rate (Capitalization Rate): Measures a property’s net operating income relative to its price. It is different from ROI in that it does not account for financing or appreciation.

Step-by-Step: How to Calculate ROI on a Multifamily Property

If you want a quick breakdown of how to calculate ROI on a multifamily property (or single-family property), this would be the way to do it.

Step 1: Start by Determining the Total Investment

Add up the purchase price, the cost of renovations and repairs, closing costs, broker fees, and any other costs that came up in the process of enquiring about the property.

Note: Loan fees can also be included.

Step 2: Calculate Net Operating Income (NOI)

The net operating income (NOI) is calculated by taking the gross rental income (and any other consistent income, like parking or laundry fees) and subtracting operating expenses.

Operating expenses may include:

- Property taxes

- Property management fees

- Insurance

- Maintenance and repairs

- Utilities (if paid by the owner)

- Other recurring costs

NOI excludes mortgage or loan payments.

Step 3: Account for Debt Service and Mortgage Payments if Applicable

The next step is to subtract mortgage or loan payments.

One tip here is that some investors only focus on NOI and do not account for debt service in their ROI calculation.

Step 4: Calculate Simple ROI

At this point, you have enough data and information to calculate your ROI. (ROI = (Net Profit ÷ Initial Investment) × 100).

But before you do, it’s recommended that you consider whether you’d like to include property appreciation in your ROI calculation.

Over time, increases in property value impact equity. Equity will show your long-term returns but may not reflect cash flow.

Example ROI Calculation

| Category | Amount | Notes |

| Purchase Price | $1,000,000 | |

| Renovations | $50,000 | Upfront improvement costs |

| Closing Costs | $30,000 | Broker fees, title fees, etc. |

| Total Investment | $1,080,000 | Sum of above |

| Gross Rental Income (Annual) | $120,000 | 10 units @ $1,000/mo each for 12 months |

| Other Income (Parking, etc.) | $5,000 | Ancillary income |

| Operating Expenses | $45,000 | Taxes, insurance, maintenance, mgmt. |

| NOI | $80,000 | (120,000 + 5,000) – 45,000 |

| Debt Service (Mortgage) | $60,000 | Annual principal + interest payments |

| Annual Cash Flow | $20,000 | 80,000 – 60,000 |

| ROI | 1.85% | (20,000 / 1,080,000) x 100% |

What is a Good ROI on Multifamily Investments?

Most investors aim for a multifamily ROI in the 6-12% range annually. However, for some investors, the local real estate market will make it difficult (or borderline impossible) to hit those metrics, making “good” more subjective and market-dependent.

Overall, higher-risk properties may have higher ROI, but there are both risks and rewards associated with this type of property.

In addition, you’ll notice that the ideal ROI threshold will vary depending on the property class. Here are some basic ranges you can work with depending on the property class you have invested in.

| Property Class | ROI Range (Annual) | Notes |

| Class A | 4% – 8% | Newer, high-end locations, stable tenants, but pricier |

| Class B | 5% – 12% | Moderate rents, stable neighborhoods, potential for growth |

| Class C | 7% – 15% | Older buildings, potentially higher returns but riskier |

Tips to Increase ROI on Multifamily Properties

If your rental property has a lower-than-average ROI, you can take steps to improve these numbers. Some of these methods for improving ROI will involve hands-on, on-site renovations and more involved rent optimization strategies. Others will be more simple, only requiring that you charge tenants charging tenants more for storage and parking.

Renovations and Upgrades

When renovating with the intent of increasing ROI, you’ll want to focus on high-impact areas like kitchens, bathrooms, and overall curb appeal. Potential tenants will be the most impacted by these upgrades. From a money management standpoint, LED lighting should be considered to reduce long-term operating costs.

A study from Resound Energy Services shows a payback of under three years for an LED lighting upgrade for multifamily investors. The study showed that more than 75% of energy consumption in multifamily properties comes from lighting.

Rent Optimization

Rental income is the most important factor for multifamily investors to be aware of. Regular rental reviews should be conducted, and adjustments should be made to match the market.

According to the National Multifamily Housing Council, the average annual rent growth over the five years preceding the pandemic was approximately 3.4%. Staying proactive with rent adjustments helps your property stay competitive and improve ROI at the same time.

Ancillary Income Streams

Many multifamily investors ignore opportunities to optimize their ancillary income streams, including on-site parking, laundry facilities, and pet fees and services.

The great thing about ancillary income streams like vending machines, ATMs, and storage or parking rentals is that they are low maintenance and utilize the space you already have available to you.

But where should you start?

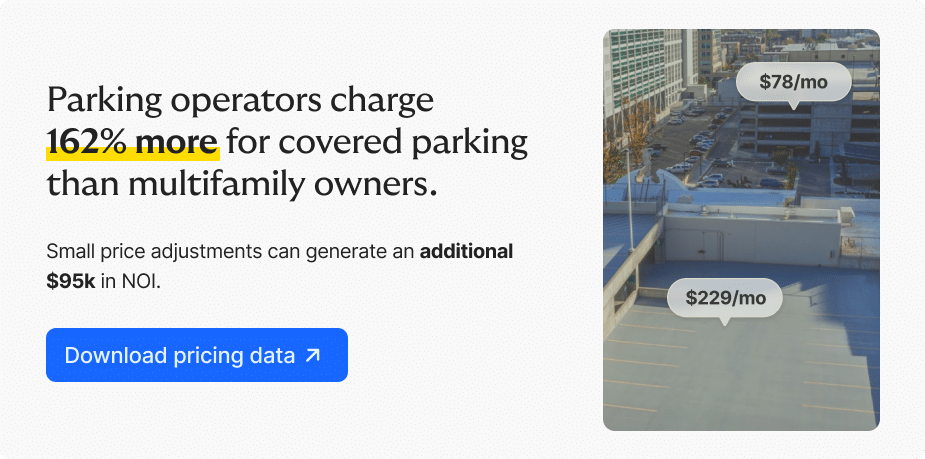

Take a look at your on-site resident parking facilities. To increase parking revenue (or NOI more generally), optimize your resident parking prices using the insights from the 2025 Multifamily Parking Intelligence Report (which contains local pricing data across 10 top markets).

You should also consider renting out vacant parking spaces to non-residents using platforms like Neighbor. Over 40% of the largest multifamily REITs already rent out unused space to non-residents.

Efficient Property Management

Professional property management can help improve ROI, but it comes at a cost. Management fees typically end up in the 7 to 12% of the monthly rent rate range.

However, these experts can ensure the timely collection of rent and streamlining operations, making them well worth the initial investment for some.

To decide if professional property management is right for you, do the math for your apartment complexes and similar properties.

Leverage Finance Options

Speak with investment professionals to consider everything from tax advantages to insurance costs and refinancing. Lower interest rates will improve cash flow and provide a higher ROI.

| Strategy | Benefit |

| Refinance Loans | Lowers monthly payments to improve cash flow. |

| Cash-Out Refinance | Funds high ROI upgrades that you can use to justify rent increases. |

| Interest-Only Loans | Reduces payments during lease-up or stabilization and functions as a short-term solution. |

| Green Loans | Covers energy-efficient improvements and reduces cost |

| Portfolio Loans | Consolidates loans to free up capital. |

| Lender Partnerships | Provides funds for property improvements if lenders offer renovation programs. |

| Manage DTI | Keeps debt low to allow future borrowing. |

Final Thoughts

Having an accurate ROI calculation is necessary to be successful in multifamily investing.

Don’t miss out on key opportunities to increase your property’s valuation and ROI by focusing on new ancillary channels (while optimizing the ones currently in place).

And if you want to gain a competitive edge, remember to use the Neighbor platform to fill parking and storage vacancies that could negatively impact ROI.