As another year passes us by, inflation remains here to stay.

The Consumer Price Index jumped more than 7% in 2022. Groceries had a much higher price hike at 13%. And electricity bills topped even that by ballooning almost 16%. The skyrocketing prices have more than half of Americans making six figures feeling like they live paycheck to paycheck. Since inflation has outpaced wage growth, households across the U.S. face tough choices. Which financial sacrifices do they make? Are they seeking out new income streams to offset higher expenses?

We surveyed 1,000 American adults for a glimpse into their spending behavior. While many of them are making cutbacks, they’re also turning to side hustles, seasonal jobs, and extra hours at their current job to relieve inflation’s strain. Americans are using these extra revenue streams to buy groceries, help make rent or mortgage payments, and afford travel.

Key takeaways:

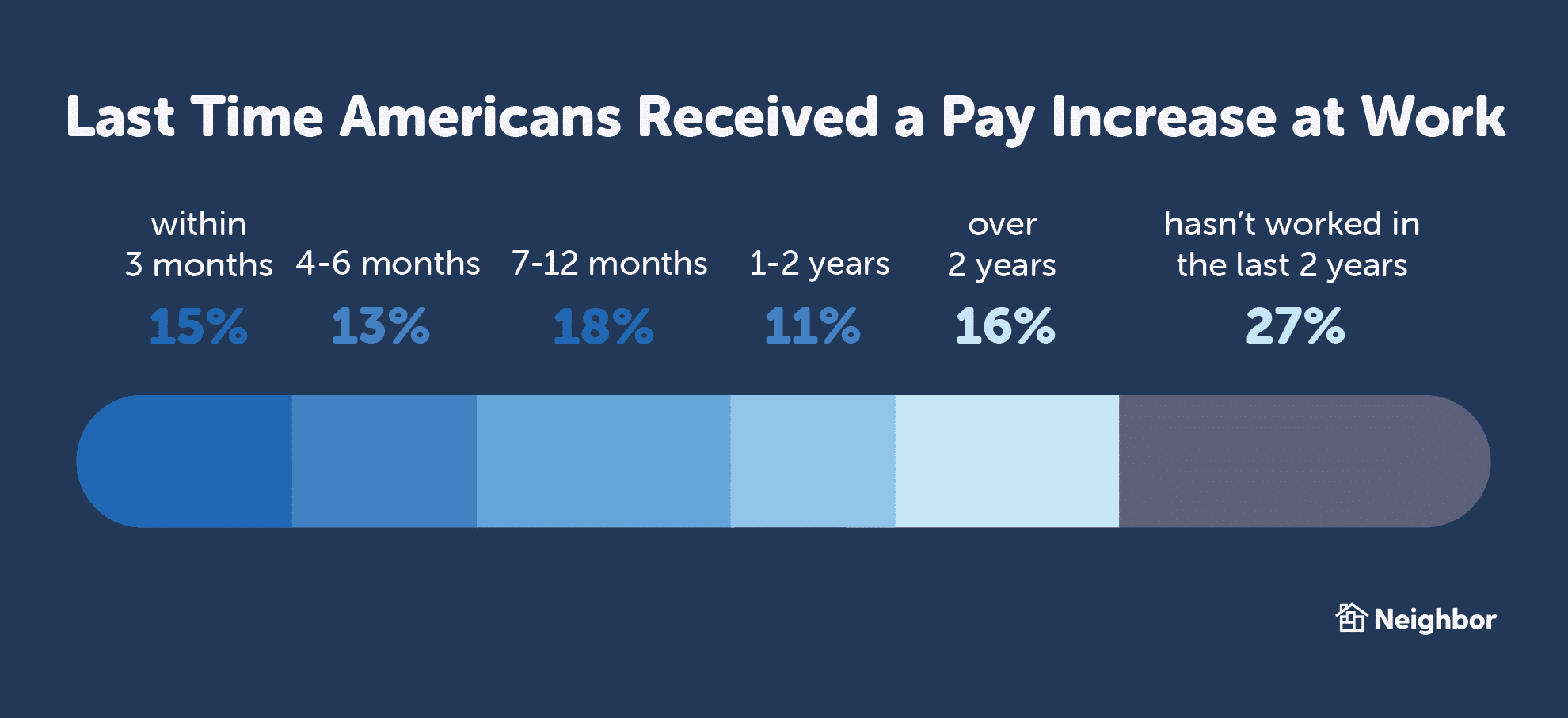

- Only 46% of Americans received a raise in the past year, despite high inflation.

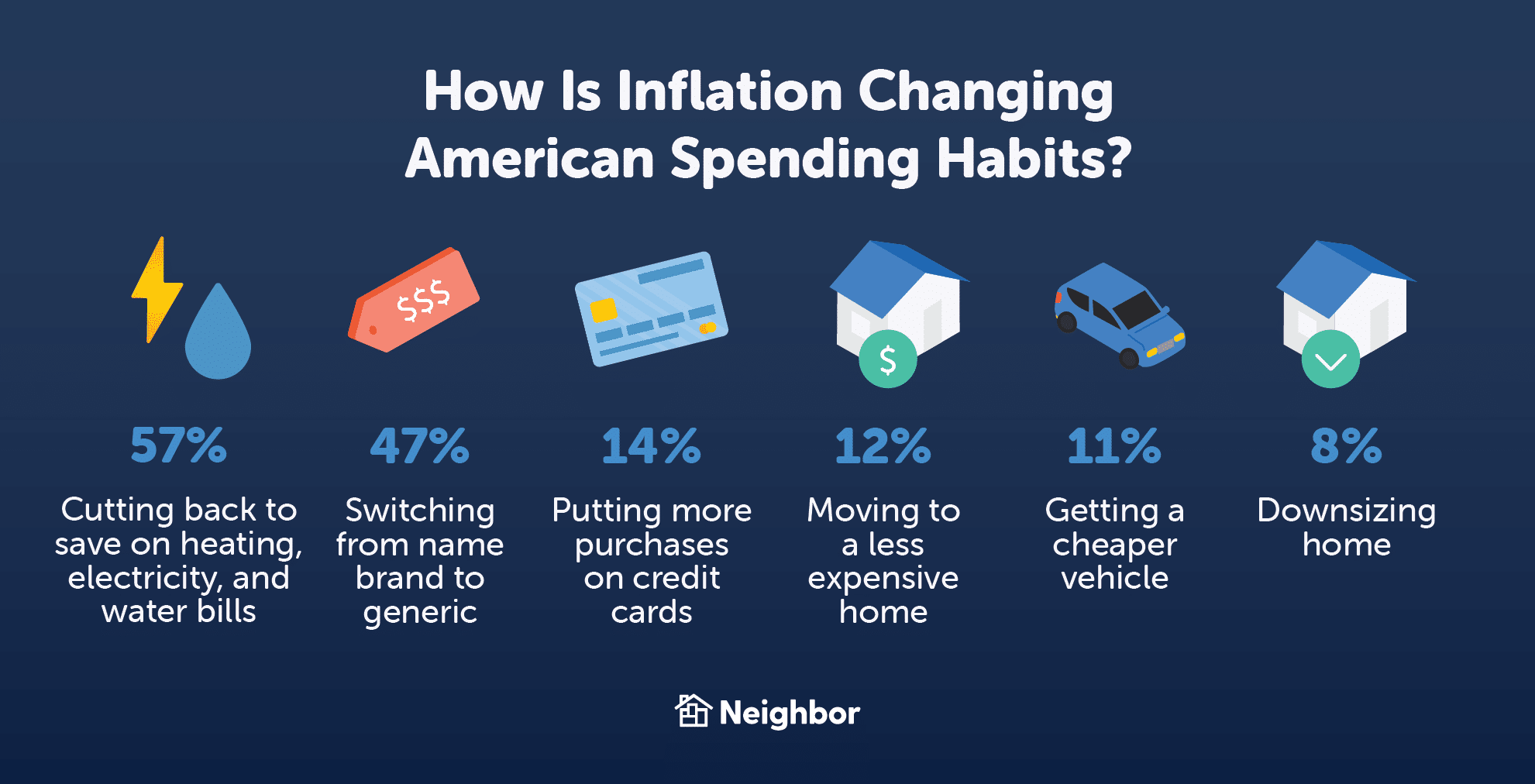

- 57% of Americans are trying to cut back on heat, water, and electricity to save money on their utility bills to account for inflation.

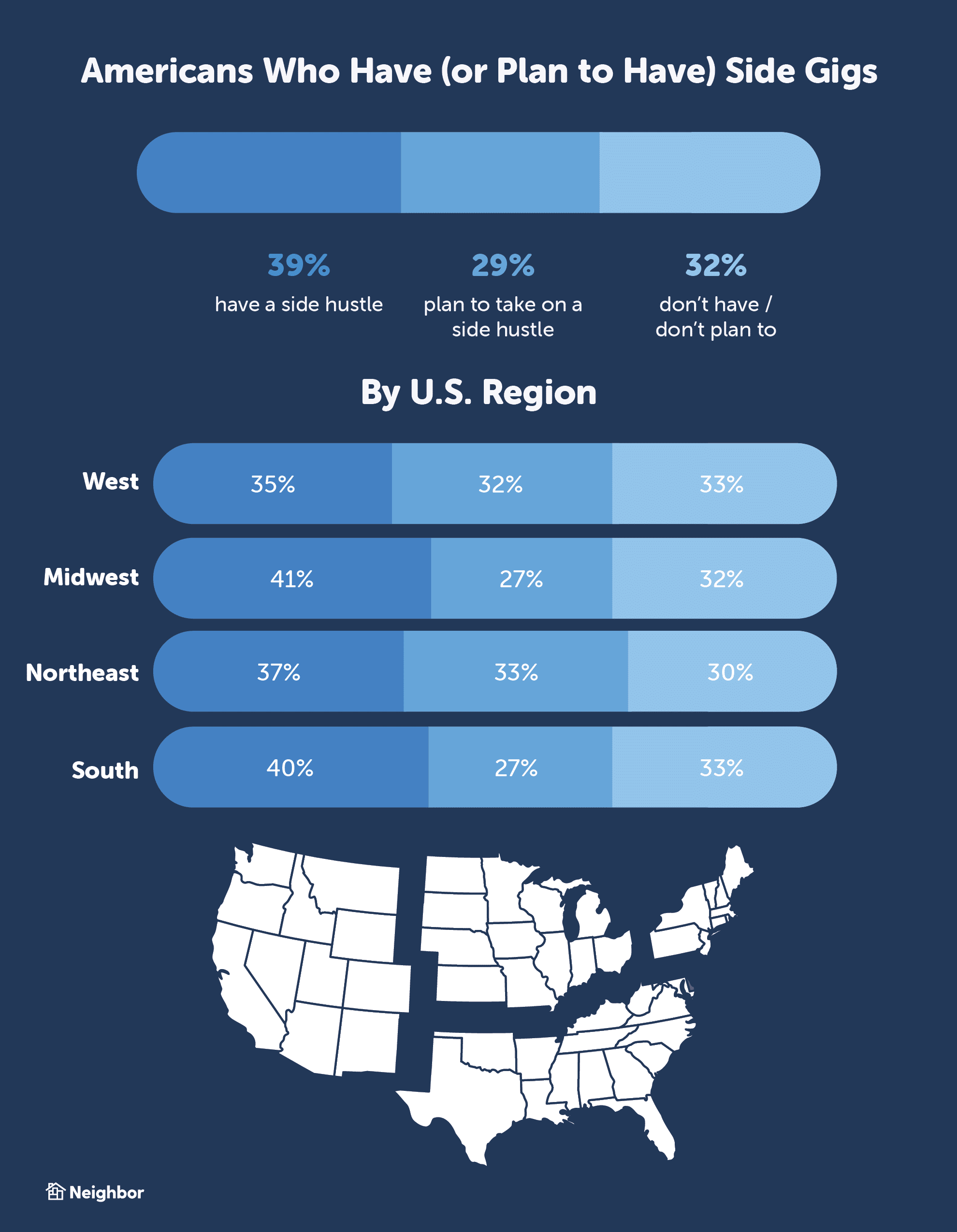

- 68% of Americans are either currently working or plan to pick up a side hustle to earn extra income.

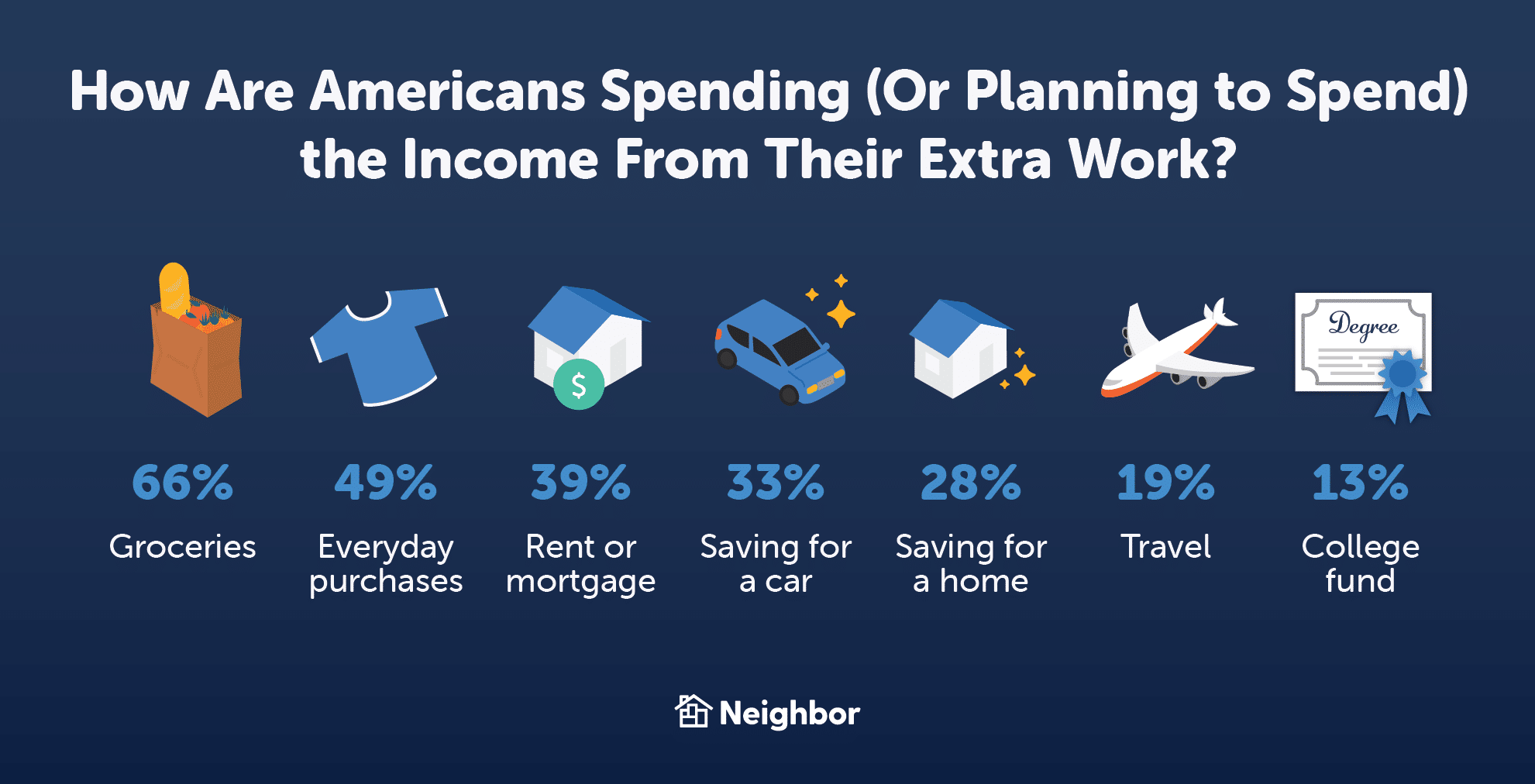

- 82% of Americans who said they either have or plan to start a side gig, seasonal job, or work overtime said inflation pushed them to seek the extra income. Two thirds of this group use these new earnings to pay for groceries.

- 60% of Americans with some version of side work earn $500 or less per month from it.

- 22% of respondents said they’d pay down debt if they had an extra $300 a month.

- Of those who plan to start a hustle, 71% said they weren’t familiar with what’s available or where to start.

Despite Inflation, Less Than Half of Americans Got a Raise This Year

Wages grew by 5.1% in 2022. But “real earnings,” which adjust for inflation, declined by nearly 3%. And even though employers across the country offered modest raises this year, many Americans were left without the necessary pay bump to account for rising prices. In fact, only 46% of Americans got a raise in the past year, with 16% not receiving one in the last two years.

Inflation Drives Americans to Cut Back on Utilities, Among Making Other Financial Sacrifices

With insufficient wage hikes, many Americans have to change their spending habits. As it turns out, more than half of our survey respondents are limiting use of essential utilities — like heating, electricity, and water — to cut the cost of their bills.

What’s more, 47% of Americans are surveying grocery store aisles for generic brands in lieu of name brands. They’re also downsizing, opting to buy cheaper cars, and putting more purchases on credit cards.

And households aren’t just cutting back on goods and services. They’re also missing out on experiences. According to our data, 45% of Americans say there was a life milestone they wanted to reach in 2022 — like marriage, retirement, or new home purchase — but couldn’t afford.

68% of Americans are either working or plan to work a side gig

There’s cutting back, then there’s keeping up. Americans are turning to side hustles, like delivering groceries or renting out part of their garage as storage space, to hold pace with how expensive everything is.

The gig economy is booming. An Orbis Market Research report projects the global freelance market to grow at a rate of 15.3% through 2026. 39% of our survey respondents said they already have a side hustle and an additional 29% plan to pick one up in the near future.

Apart from side hustles, 44% of Americans currently work or plan to work a seasonal job, like unloading boxes at an Amazon warehouse or stocking shelves at a Walmart. And 51% either currently work or plan to work overtime at their current day job.

2 in 3 Americans Who Have (or Plan to Take on) Extra Work are Using the Money for Groceries

66% of Americans who either have or plan to get a side gig, seasonal job, or extra hours at their job are using the ancillary income to buy groceries — one of the expenses most impacted by inflation.

4 in 5 Americans Who Have (or Plan to Take on) Extra Work Said Inflation Pushed Them to Seek it Out

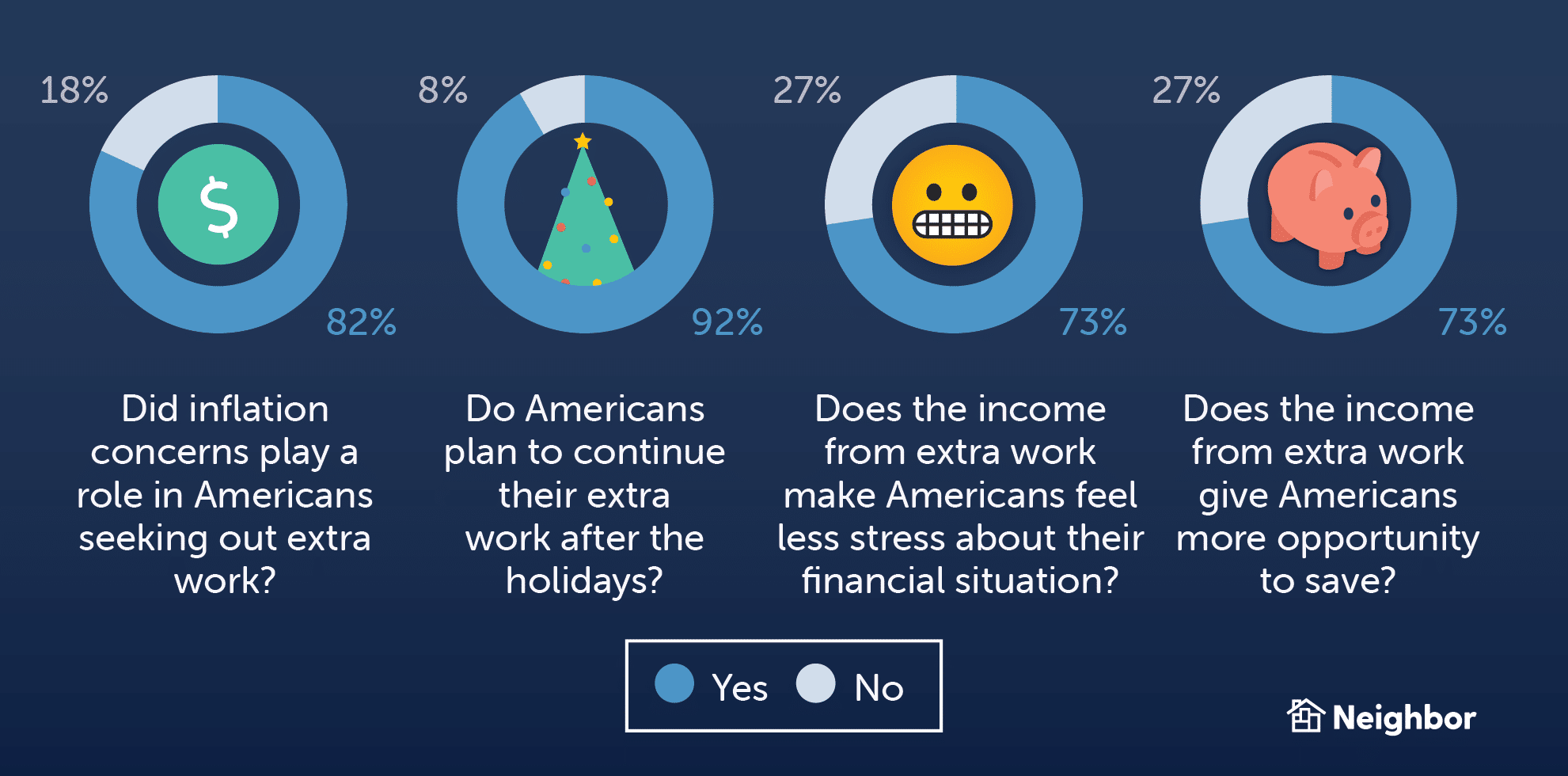

It makes intuitive sense, and the data backs it up: inflation concerns are driving people toward side hustles. In fact, 82% of Americans who have or plan to get a side gig, seasonal job, or extra hours at work say inflation factored into their decision.

And this isn’t just an end-of-year sprint to afford holiday expenses. Almost half of Americans planned to spend more money on the holidays in 2022 compared to 2021 and likely picked up side gigs to make up the difference. But it looks like they’re committing long-term, as more than 9 in 10 Americans plan to continue their side hustle, seasonal job, or extra work hours after the holidays.

Our study also shows that in this economic climate, 73% of Americans with extra work feel like the supplemental earnings bring less stress about their financial situation and more savings.

But which side hustles are Americans choosing? Amid the flurry of options, gig workers are turning to food and grocery delivery, rideshare driving, and renting out living and storage space.

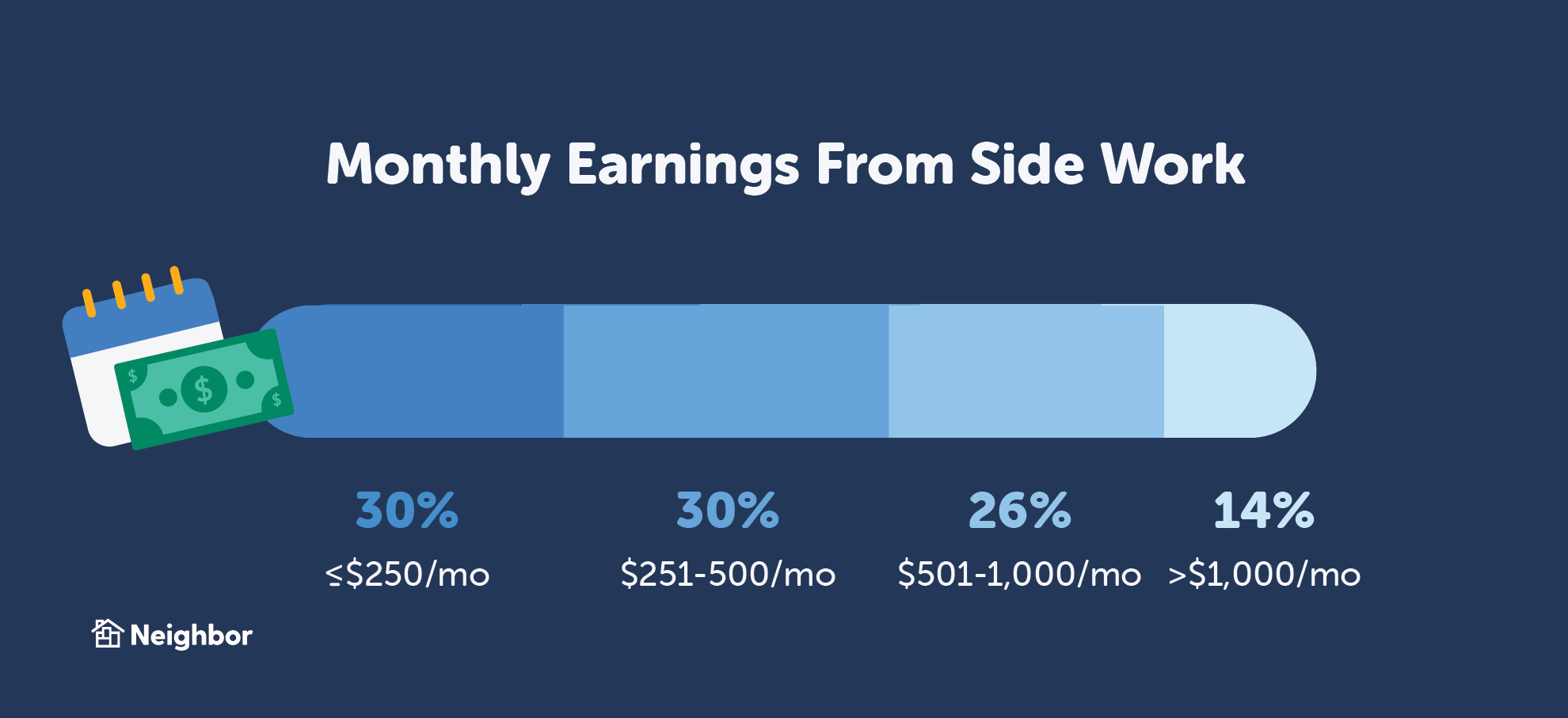

Most Americans Who Take on Extra Work Earn Up to $500 Per Month in Extra Income

According to our study, 3 in 5 Americans earn as much as $500 from their side hustles, seasonal jobs, or extra work hours. Since inflation adds $341 in expenses to U.S. households every month, many gig workers are earning enough extra income to cushion the blow.

22% of Americans Would Pay Off Debt With an Extra $300 a month in income

While most Americans won’t get rich off their side gigs, having a few extra hundred dollars in monthly earnings can help households meet financial goals. We wanted to know how American adults would spend side gig income, and found that 1 in 5 would strive to pay down debt. Other popular options were saving for a new car or down payment on a home.

Many Americans Without Side Gigs Want Them, But Worry They Don’t Have Time

Of the people who said they plan to start a side hustle, 71% said they weren’t familiar with what’s available or where to start. Americans without side hustles also cited time concerns — 61% said they could only dedicate somewhere between 1 and 10 hours a week to a supplemental gig. This makes a strong case for seeking out passive income streams, like renting out space you already own, which allows workers to fit more hands-off gigs into busy schedules.

Survey Methodology

Using Pollfish.com, we surveyed 1,003 American adults on October 30, 2022. Respondents had to be 18 years or older to participate. Survey respondents were all based in the U.S.

Respondents were 44% male and 56% female. Their ages were:

- 18-24: 16.35% of respondents

- 25-34: 21.73% of respondents

- 35-44: 29.41% of respondents

- 45-54: 18.84% of respondents

- Over 54: 13.66% of respondents