The worst day of the year just might be tax day. Sometimes a worse day could be when you move homes. Sometimes one could affect the other. Hopefully, they affect each other in a positive way. Here are some common questions on how your moving expenses affect your taxes. Most people want to nab all the tax deductions they can find, so your move is a great place to start looking. If you aren’t sure where to start the search, check these FAQ’s.

Moving Expenses and Tax Deductions

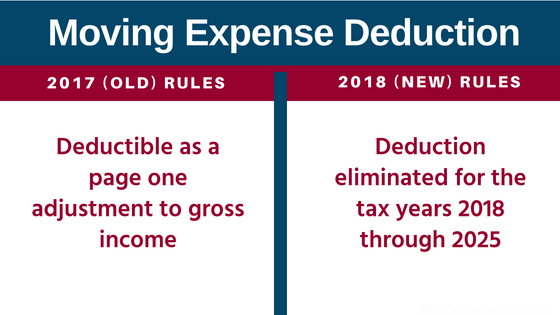

The Tax Cuts and Jobs Act that was passed in December 2017 eliminated this deduction. However, these changes are not permanent as the moving expense deduction will be reinstated in 2025. Unless Congress intervenes to eliminate the deduction then you will be able to deduct your moving expenses in a few years. If you moved in 2017 then you will be able to claim the expenses on the tax return you are set to file in 2018. Or if your employer reimbursed you for moving expenses, that reimbursement might be excludable from your income. So don’t wait on Congress, if you moved in 2017 make sure you qualify and get those tax deductions!

Picture Source: BKC

Are moving expenses tax deductible?

As of January 31 (see the IRS Website) you can write certain moving expenses as tax deductions only for years prior to 2018, if it is related to a change of work and only if you meet all of the following qualifications:

- Your move closely relates the start of work: Your move (and its incumbent expenses) must be within 1 year of reporting for the new job.

- Distance Test: Your new job is more than 50 miles farther from your old home than your old job was.

- Time Test: If you are full-time you must work 39 weeks out of the following year (If you are self-employed then you must work 78 weeks, full-time, out of the following two years).

** If you are relocating due to military orders, you do not need to qualify for the Distance or Time Tests, and certain military members may still be able to qualify for these deductions despite the recent changes to the tax law **

Are moving supplies tax deductible?

Here’s a quote from the IRS website, “You can deduct only those expenses that are reasonable for the circumstances of your move.” With that in mind, you can, in fact, deduct the expenses of moving supplies as long as they are not personal purchases or business expenses.

**Any moving expenses reimbursed by an employer cannot be used as tax deductions**

Are moving expenses part of itemized deductions?

Itemizing only helps your tax profile if you spent more than the IRS has already allowed as a tax credit. So, no, generally moving expenses are not itemized. They go toward your gross salary and therefore lower your taxable income. This may even help you qualify for other low-income tax exemptions.

Is a relocation bonus taxable income?

In answering this question, I’d like to talk a little bit about taxes and tax deductions. Let’s remember that there is no such thing as a double deduction. You can’t deduct something as a personal expense and as a business expense. That will earn you an orange jumpsuit. Deductions are a way of telling the government not to tax you twice.

For example, let’s say you have a business, you buy materials (which are taxed at the sale), you pay employees (which are taxes through employment taxes and income taxes) and you sell your items (which are then taxed at the sale). You can deduct some of these expenses so you don’t pay double taxes (the system is not perfect and there will still be some overlap of taxes).

When wondering about moving expenses, and asking what is tax deductible and what isn’t, think about what gets taxed twice and what helps produce. Those two things are likely candidates of being tax deductions. This unfortunately no longer applies in light of the recent changes to the current tax law.

With that said, let’s look at the question of whether relocation bonuses are taxable income. Simply put, yes they were. They were seen as an increase of income. Therefore, Uncle Sam took his cut of the pie. It didn’t matter if the bonus was to cover moving expenses. It was still taxable income. Don’t let that get you down. It’s still a bonus right?

Are storage costs tax deductible?

Yes, storage costs can be tax deductible as long as they are necessary and the move qualifies for the three tests mentioned above. This means that even services like Neighbor (which are often cheaper) qualify as tax deductions under the right circumstances.

Conclusion

Ben Franklin said, “the only sure things in life are death, and taxes.” That’s true, but luckily, in certain cases, it can be minimized. Thanks to recent tax reform passed last December, moving expenses cannot be deducted for taxes unless they are for years prior to 2018. The good news is that the moving expense deduction will be back in 2025 unless further reform is passed.

So if you’re planning to move seven years from now, you might be able to get your tax deduction. Just make sure your move is closely related to your work and it meets the time and distance tests. Also remember you can deduct your storage costs and moving supplies. Your relocation bonuses are in fact taxable income, but hopefully the move in general has helped to lower your taxable income.

These are very specific answers to very specific questions, but this is not tax counsel. This is just researched information. If you need more help, we strongly advise you to seek it from a reputable tax professional.