If you own underperforming properties, it might be time to evaluate your management strategies. Property management consulting services can offer solutions to optimize operations, reduce turnover, and boost your net operating income (NOI).

Of course, you’ll want to ask some questions before you shell out thousands of dollars per month on professional property management consulting.

- Firstly, will your portfolio specifically benefit from real estate consulting services?

- Is hiring a consultant the right move for a property of that size?

- Will the revenue generated offset the monthly fees a consultant charges?

Here’s a straightforward look at the pros and cons to help you decide.

What Is Property Management Consulting?

Working with consulting firms involves hiring an expert to assess your property operations and identify areas for improvement. These consultants often have extensive experience in the real estate market and are adept at building strategies to maximize efficiency and profitability.

They might offer insights on:

- Tenant retention

- Leasing practices

- Operational workflows

- Growth strategies

- And more!

Pros

#1: Money-saving Expertise

A property management consultant brings industry expertise to the table, which is especially beneficial for budding real estate investors. Based on financial analytics, they’ll help streamline rent collection, identify cost-saving maintenance practices, or implement technology like tenant portals.

Instead of trial and error, you benefit from strategies that are proven to save time and reduce operational expenses.

#2: Objective Assessments

Sometimes, being too close to a property means missing inefficiencies. A consultant provides an unbiased perspective, identifying weak points you might overlook. Whether it’s a problematic vendor contract or ineffective marketing for vacant units, their fresh take can uncover overlooked opportunities.

#3: Reduces Turnover

Turnover is costly (in some cases, even more costly than a professional property management consultant). Consultants can evaluate tenant feedback, your leasing process, and the amenities offered to address factors that lead to vacancies. For example, if tenants leave due to inadequate parking, a firm might suggest reorganizing spaces, adding covered parking, or monetizing prime spots.

#4: New Ideas and Custom Solutions

Every property is unique. A skilled consultant tailors recommendations to your specific needs (and property types), whether you’re managing a small apartment complex or a portfolio of multifamily properties. Their strategies are scalable and adaptable to your organization.

Cons

#1: Upfront Costs

Consulting firms don’t come cheap. Depending on the consultant’s industry experience and scope of work, rates can range from a few hundred to several thousand dollars. This can be daunting for smaller property owners, especially if the ROI isn’t immediate.

#2: Not a Long-Term Fix

Consultants offer recommendations but don’t implement changes for you. If your property management team isn’t prepared to follow through, the advice may go unused.

#3: Disruption and Risk

The evaluation process can temporarily disrupt daily operations. Consultants may interview staff, survey tenants, or audit records, which might strain your team if they’re already stretched thin. Like any change, there is also a possibility that it won’t work. There are no guaranteed outcomes.

#4: Potential Misalignment

Not all consultants are created equal. If they lack experience with your type of property or don’t fully understand your market, their recommendations may miss the mark. Vetting their expertise and understanding their strategy is critical before taking any advice.

#5: Dependence

Relying too heavily on consultants could lead to a lack of internal problem-solving skills. If you continually need to bring in outside help, it might signal deeper management issues that require in-house solutions.

Deciding whether to hire a property management consultant depends on several factors, including your goals, challenges, and financial position. Consultants can provide expertise in streamlining operations, improving tenant retention, and boosting net operating income (NOI), but their services come at a cost.

Here’s how to evaluate whether this step is right for you.

First, assess your property’s current state. What are you trying to achieve? Are you facing persistent challenges like high tenant turnover, inefficient processes, or stagnant revenue? If so, a consultant might be the solution to identify pain points and develop tailored strategies to address them. However, if your property operates smoothly and consistently meets performance benchmarks, the additional expense of hiring a consultant might not provide significant returns.

Should You Hire a Property Management Consultant?

Here’s a simple flow chart to help determine if hiring a consulting firm could help you.

1. The First Step – Define Your Goals

- Are you trying to improve NOI?

- Are you aiming to reduce turnover?

- Do you need help optimizing ancillary income (e.g., parking spaces, pet fees, etc.)?

If “Yes” to one or more, proceed to Step 2.

2. Evaluate Current Challenges

- Do you have high vacancy rates or tenant complaints?

- Are maintenance requests slow to resolve?

- Are you struggling to stay competitive in the market?

If “Yes,” your property could benefit from an outside perspective.

3. Consider Your Budget

- Can you allocate funds for consulting fees without straining your finances?

- Have you researched the average cost of property management consultants in your area?

If “No,” consider addressing low-cost improvements first, like better tenant communication or upgrading amenities.

4. Assess Internal Capacity

- Do you or your team have the time and expertise to investigate the culprits of your high vacancy rates?

- Have previous DIY attempts to solve these problems been ineffective?

If “No,” a consultant could provide the expertise and bandwidth you lack.

5. Research Potential ROI

- Could changes recommended by a consultant realistically offset their costs?

- Are there measurable improvements consultants have delivered for similar properties?

If “Yes,” hiring a consultant might be a worthwhile investment.

Maximize NOI With Ancillary Income Channels

One way to improve NOI, whether or not you hire a consultant, is by optimizing underperforming amenities like parking. Platforms like Neighbor allow you to list vacant parking spaces and rent them to non-residents. If your property has unused spots, this strategy can turn empty spaces into a reliable revenue stream.

It doesn’t stop with parking spots, either. If your properties have vacant units or other types of extra space, like an attic, basement, or driveway, you can turn that unused space into a revenue-generating self-storage unit. The cool thing is Neighbor finds qualified renters for you so you can focus on filling your apartment vacancies.

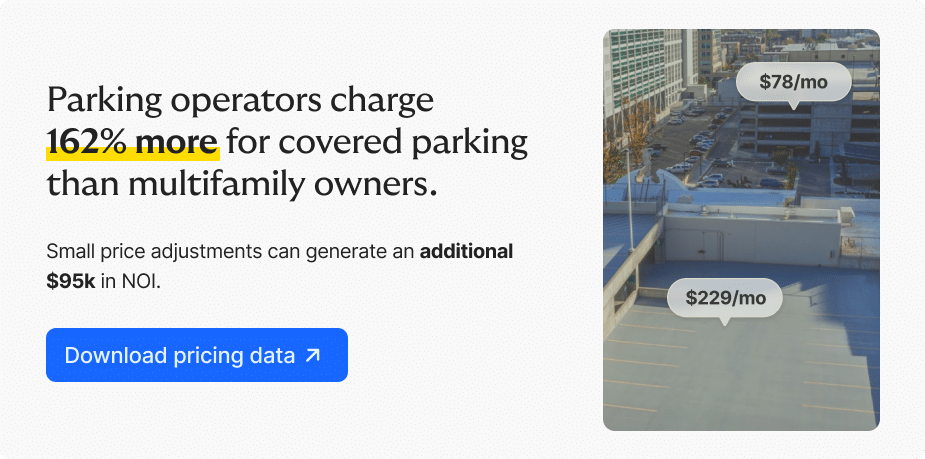

Other ancillary income opportunities include charging for premium amenities like covered parking, pet fees, or EV charging stations. These small changes can significantly impact your bottom line.

Conclusion

No question – property management consulting has its benefits – from expert insights to custom solutions, but it’s not without its challenges. Weigh the costs and potential disruptions against the long-term value a consultant could bring to your business. For investors with underperforming properties, this might be the key to unlocking better operational efficiency and improved NOI.